On-call arrangements continue to be an ongoing challenge for hospitals and healthcare systems. Ensuring continuity of coverage for not only emergency departments (ED) but for inpatient specialty practices has proven difficult for a variety of reasons. Many hospitals are required to maintain a panel of on-call physicians in order to preserve their trauma status and for regulatory compliance requirements.

However, the volume and acuity of ED coverage has increased across the country. Those changes, coupled with the lowering supply of physicians and advanced care practitioners and providers’ increased focus on work-life balance, have resulted in overall increases in on-call pay in order to ensure proper coverage.

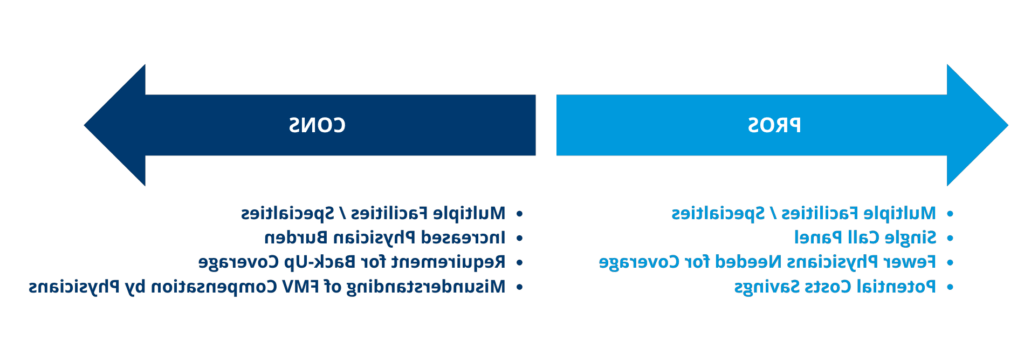

What should you consider when setting up on-call arrangements?